Quantitative Risk Analysis

The Quantitative Risk Analysis Difference

Is your organization ready to move up to the maturity of quantitative risk analysis techniques? While qualitative analysis techniques may suffice for smaller projects, larger, more important projects demand the stringency and insight that only quantitative analysis techniques can provide.

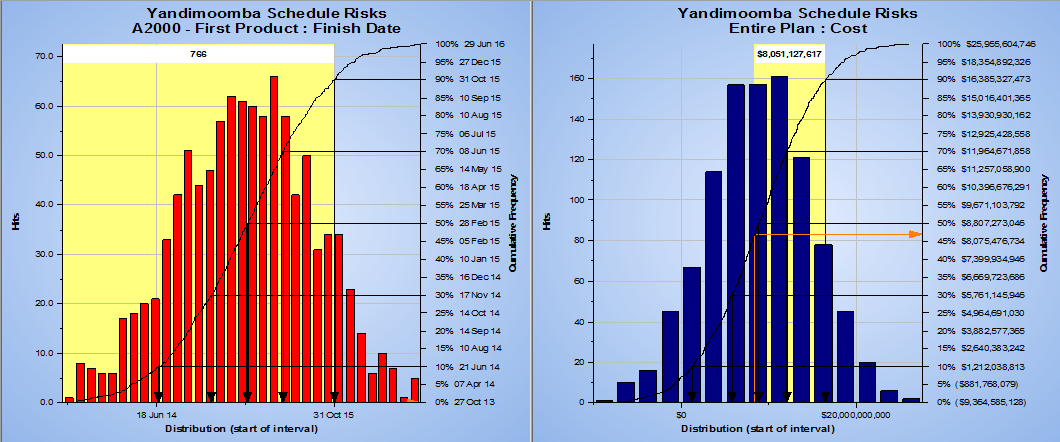

Quantitative risk analysis techniques allow you to apply a proven mathematical approach to the calculation of appropriate levels of project schedule and cost contingency.

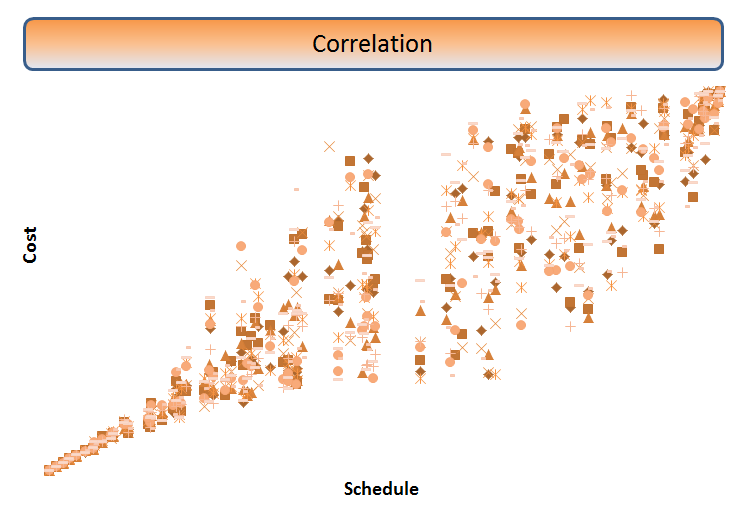

Further, quantitative techniques help us understand the effective schedule risk drivers and cost risk drivers of projects to help better understand and manage risk / uncertainty.

Quantitative Risk Analysis Services

At RIMPL, we offer three core quantitative risk analysis services:

Quantitative Risk Analysis Methodology

We place equal emphasis on the role that effective risk management and analysis have in exposing and exploiting opportunities, as well as threats, to give you a balanced perspective of your risk exposure.

We believe that risk analysis shouldn’t be a “black box” mystery process, and our consultants will work with your project team to help you understand not only how the outcomes were derived, but also the biggest determinants of uncertainty within your risk model.

Our market leading, independently reviewed Monte Carlo methodology using Primavera Risk Analysis has been successfully applied to a wide range of projects in a variety of industries, including projects worth many billions of dollars in capital value.

See our Knowledge Base for more information, or refer to each of the links above to see how our people can help you better understand your risk exposure and determinants of uncertainty.

|