Integrated Cost and Schedule Risk Analysis

What is Integrated Cost & Schedule Risk Analysis?

Integrated Cost and Schedule Risk Analysis (IRA) represents the cutting edge of Monte Carlo project risk analysis practices.

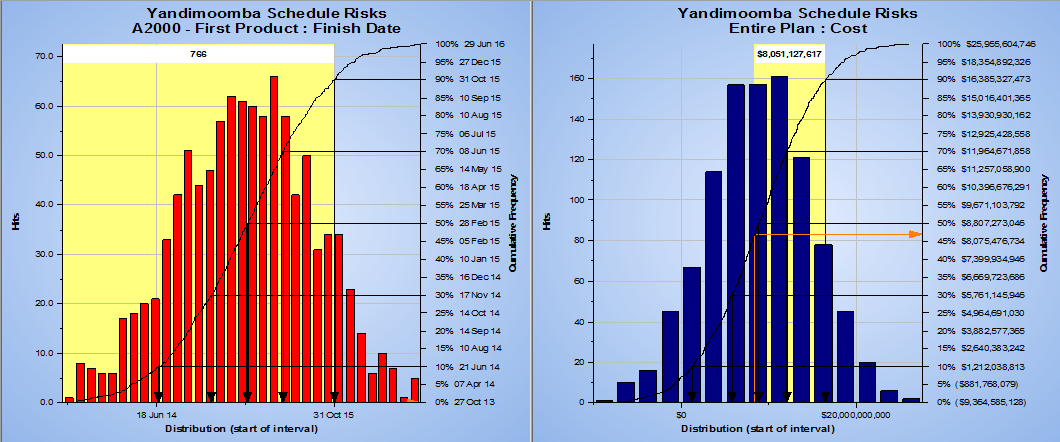

As the name suggests, it is a means of conducting quantitative risk analysis simultaneously on the schedule and the estimate, to assess accurately the cost consequences of all identified time and cost uncertainties and risk events.

The primary objective of Integrated Cost and Schedule Risk Analysis is to jointly assess the requirement for project schedule contingency and cost contingency by more accurately modeling the cost of delay depending on where and how delay affects the project schedule.

Our Integrated Cost-Schedule Risk Analysis Methodology

Unlike stand-alone cost risk analysis techniques, Integrated Cost and Schedule Risk Analysis does not need to make broad generalisations regarding the cost of schedule delay, as costs are applied directly to the activities to which they relate.

Therefore, if a task with time dependent costs (such as labour) shortens in the schedule model, the cost impact of time will decrease accordingly.

Also unlike the conventional process of feeding allowances from schedule risk analysis into cost risk analysis, the schedule drivers of cost can be quantified and ranked with the cost drivers to give the project team the best possible understanding of the ranked drivers of project cost.

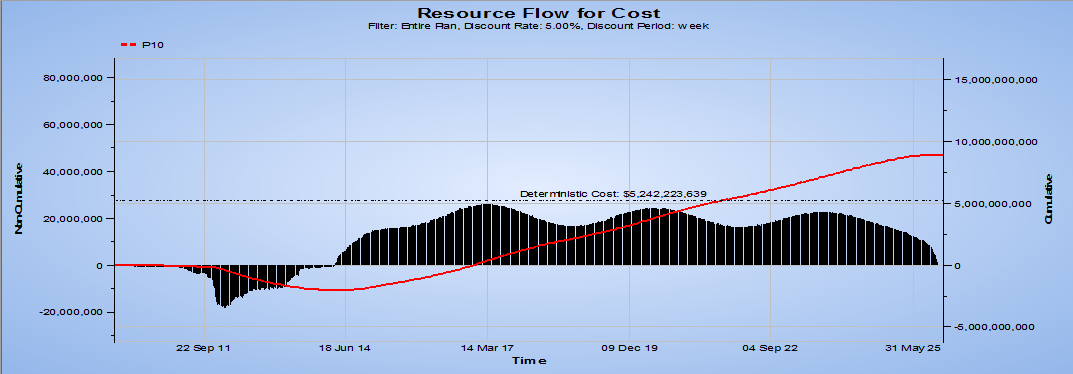

More recently, we have incorporated operational and business risks and uncertainties into our IRA modelling, together with the definable interest rate costs of project finance borrowing and selectable discount cash flow rates, to provide meaningful Probabilistic NPVs and Rates of Return.

More recently, we have incorporated operational and business risks and uncertainties into our IRA modelling, together with the definable interest rate costs of project finance borrowing and selectable discount cash flow rates, to provide meaningful Probabilistic NPVs and Rates of Return.

Thanks to this approach, we can quantify and rank time and cost drivers to enable Financial Investment Decision makers for the project to understand the balance of probabilities between profit and loss and the sensitivity of the probabilistic profit and loss balance to risk factors, risk events and time and cost uncertainties.

RIMPL’s IRA methodology is the first to be developed and implemented in Australia and is several years ahead of most in terms of developmental sophistication.

RIMPL’s IRA methodology is the first to be developed and implemented in Australia and is several years ahead of most in terms of developmental sophistication.

The methodology is founded on software developed over the last 7 years.

The RIMPL Integrated Cost & Schedule Risk Analysis Methodology was described in an invited paper published by Australian Risk Management Today in May 2011.

A more recent capability of Forecasting Profit Versus Loss is described in another invited paper for the same journal (published in September 2013).

We’ve successfully applied RIMPL’s integrated cost and schedule risk analysis methodology to projects valued from a few million dollars to over $20 billion in capital value and at various stages of the project lifecycle.

How could we help better identify and manage uncertainty on your project? Contact us for more information.

|